Do you want to eliminate the stress that this time of year can bring, and instead use it as a time to enjoy family and friends, without having to...

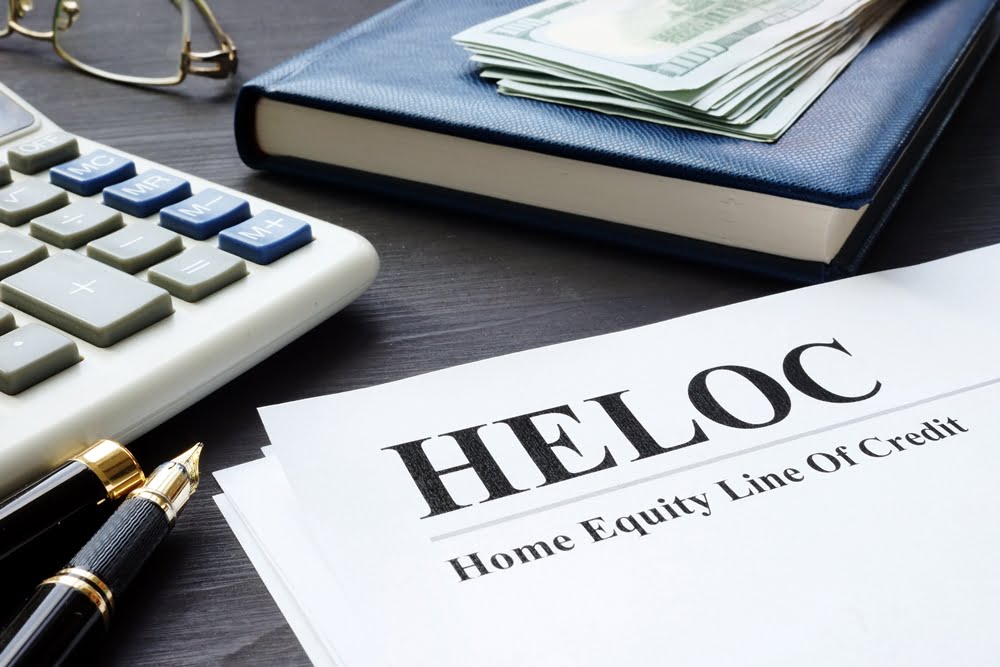

Home equity is defined as the gap between the value of your home and what you currently owe on your mortgage. If you have home equity, you may want...

Most lenders will want to see the following 6 things when we send up an application for a mortgage approval: 1. Your credit history 2. Your gross income (income...

You are probably wondering what a cashback mortgage is and why would I get one? This is where you can get anywhere from 1-5% of the total mortgage amount...

When obtaining a mortgage, there is always the question of a fixed or variable interest rate. There are pros to cons to both types, which we will explore below....

With cannabis legalization in Canada coming into effect on October 17, 2018, many landlords are wondering about their rights as landlords and how the legalization will affect their rental...

Are you saving enough for your retirement?Many Canadians think of retirement as a time filled with vacations, getaways to the cottage and spending more time on hobbies and interests....

Budgeting for the holidays now may sound like a chore, but it is key to avoiding financial stress in January. Here is a guide to plan for the holiday...

After the holidays we all can relate to the dread of opening a credit card statement and wondering how long it will take you to pay off holiday debt. ...